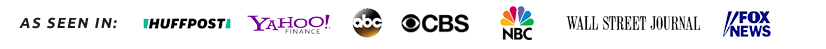

In order to have the greatest chance at getting the lowest interest rates or best terms for any of these things mentioned above,

You’ll want to have the best credit scores possible.

Yet there may be hidden obstacles that could harm your chances at getting approved:

Errors, late payments and hard inquires on your credit reports.

Credit reporting errors are surprisingly common. Unfortunately, it’s up to you to discover & report any inaccurate information in your files.

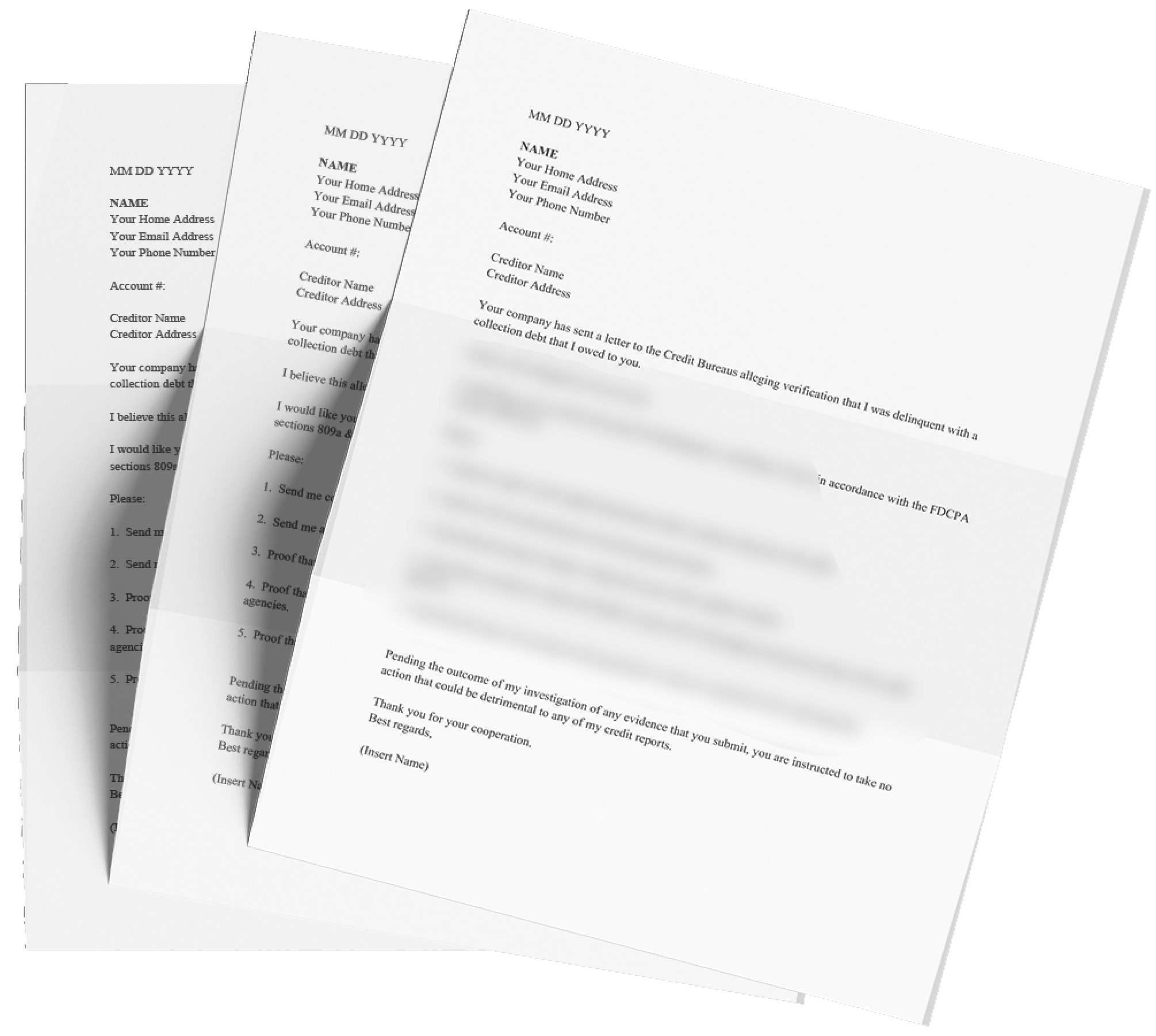

Equifax, TransUnion and Experian, the three major credit bureaus, let you dispute inaccuracies on their respective consumer credit reports by mail. You can use annualcreditreport.com to check your credit reports for free.

Fortunately, it is possible to get these errors removed.

You’ll need to file a credit dispute letter, which isn’t difficult.

There are no penalties for disputing errors on your credit reports.

If you don’t agree with the outcome of a credit dispute, you can file a complaint with the Consumer Financial Protection Bureau.

Note: We have already crafted these credit dispute letters which eliminates the need to write a letter — but you’ll still need to mail in the dispute letters, to challenge errors, late payments, hard inquires or collections.

We’ll show you exactly how to file these dispute letters for FREE!

PS: Now is the best time to file these dispute letters because many of the employees that are responsible for verifying the accounts are working remote, which means they don't have access to the file necessary therefor they must remove these items from your credit report!